property tax assistance program montana

The exemption amount varies based on income and marital status as determined by the Montana Department of Revenue. Tax rates are calculated by local jurisdictions Determining tax rates.

Montana Income Tax Information What You Need To Know On Mt Taxes

Montana Down Payment Assistance.

. Web A disabled veteran and certain spouses in Montana may receive a property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of service. Property Assessed Clean Energy. Web MBOH Plus 0 Deferred Down Payment Assistance Program.

PO Box 200528 Helena MT 59620-0528 Send us an Email P. 0 second loan no monthly payments. Department of Revenue Data extracted from Orion.

The percentage at which your property is taxed. Contact Customer Service Helena Office. Assistance for Business Clinic to be Held in Great Falls at the University of Providence.

Through its EnergyMineral Impact Assistance Fund Grant program the Colorado Department of Local Affairs offers funding for municipalities counties and special districts to cover the cost of AFVs for public fleets. The PTAP benefit applies to the first 200000 of the primary residence market value. 1 In some of these states such as Arkansas and Colorado there are no statutes allowing armed school personnel but also no laws explicitly prohibiting it and state policymakers have decided to allow or encourage.

Learn more about Montana Residency or see the NonresidentPart-Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for more information. For married filing separate returns the amount is increased to 5250 previously 2500. Web As of January 1 2020 28 states allow schools to arm teachers or staff in at least some cases or as part of a specific program.

Can be used for down payment and closing cost assistance. Web MONTANA- The Montana Department of Labor Industry announced today that two Montana businesses in Flathead County and one in Missoula County are the winners of the 2022 Montana State. Web EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms.

Elderly Persons with Disabilites Special Needs Families with. You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in. This tax credit allows buyers to acquire better mortgage financing in a very competitive market.

Web You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state. Available for up to 5 of sales price maximum 10000. Web PROPERTY TAX ASSISTANCE PROGRAM.

Broadcasters hit for airing program-length commercials during kids shows which they concede but say was inadvertent. Tal como comprender los costos gastos y ganancias netas de su negocio. Web Residential EVSE Financing Program.

4068412702 ABOUT About Montana Housing. Elderly Persons with Disabilites Special Needs. Box 35010 County Courthouse - Room 108 Billings Montana 59107 406 256-2802.

Learn more about Montana Residency or see the NonresidentPart-Year Resident Ratio Schedule instructions in the Montana Individual income Tax Return Form 2 Instruction Booklet for. If you have not received a tax statement by November 1st please contact the Treasurers Office at 406-874-3427 to request a duplicate statement or to request an address change. Generally the property tax rate is expressed as a percentage per 1000 of assessed value.

John Eggerton published 21 September 22. Web FCC Floats Multimillion-Dollar Fines Against Sinclair Nexstar and Cunningham TV Stations. It does not reduce the amount of.

AFV Conversion Tax Credit. Property TaxRentHeat Rebate Program. For 2021 the amount is increased to 10500 previously 5000.

La elaboración de una declaración de ganancias y pérdidas le puede ayudar a comprender el estado financiero de su negocio. 406 444-6900 Office Locations Mailing Addresses. Also known as the Gonsalves-Deukmejian-Petris Property Tax Assistance Law this program provides direct cash reimbursements from the state to low-income seniors 62 or older blind or disabled citizens for part of the property taxes on their homes.

Web Property Tax Assistance Program Application Form PTAP 2022. Web Payments - Yellowstone County Treasurers Office PO. The veteran must have 100 disability from an injury related to service.

His paternal grandfather emigrated from Germany and his paternal grandmother a devout Christian was a first-generation. Web You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state. ASCII characters only characters found on a standard US keyboard.

Due upon transfersale of property or refinancepayoffof first loan. Reductions from 30 to 80 are determined by marriage status and income range. Web Contact Information Montana Housing MONTANA DEPARTMENT OF COMMERCE 301 S.

Requires a Montana Housing 30-year first mortgage fixed. Web The tax roll is prepared and maintained by the State of Montana Department of Revenue Assessors Office. Web Vehicle insurance in the United States also known as car insurance or auto insurance is designed to cover the risk of financial liability or the loss of a motor vehicle that the owner may face if their vehicle is involved in a collision that results in property or physical damageMost states require a motor vehicle owner to carry some minimum level of.

Web Early life education and medical career. Ronald Ernest Paul was born on August 20 1935 in Pittsburgh the son of Howard Casper Paul 19041997 who ran a small dairy company and Margaret Paul née Dumont. The taxing jurisdiction school district municipality county special district develops and adopts a budget.

Must contain at least 4 different symbols. Ownership Assessment Data is maintained by the MT Department of Revenue. Emergency Rental Assistance Program ERAP Tenant-Based.

6 to 30 characters long. Web The Montana Disabled Veterans MDV Assistance Program helps disabled veterans or their unmarried surviving spouse by reducing the property tax rate on their home. Quickly search property records from 318 official databases.

Web Property tax rate. Tax payment information updated twice. Web Its Mortgage Credit Certificate program MCC provides eligible first-time homebuyers with a chance to reduce the amount of federal income tax owed each year they own and live in the property.

Web Comenzó su negocio pero no sabe si está obteniendo ganancias. Web The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employees income through a dependent care assistance program. Web Montanas Property Tax Assistance Program PTAP reduces the property tax rate for citizens on a fixed or limited income.

This is effected under Palestinian ownership and in accordance with the best European. Web Looking for FREE property records deeds tax assessments in Montana.

Tax Breaks For Montana Property Owners Inspect Montana

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue

Ci 121 Montana S Big Property Tax Initiative Explained

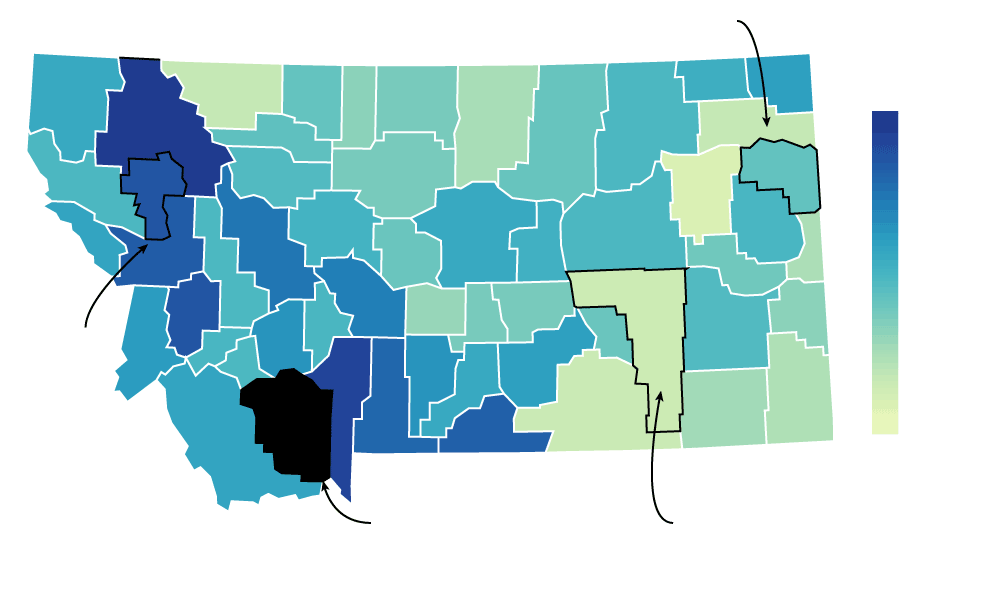

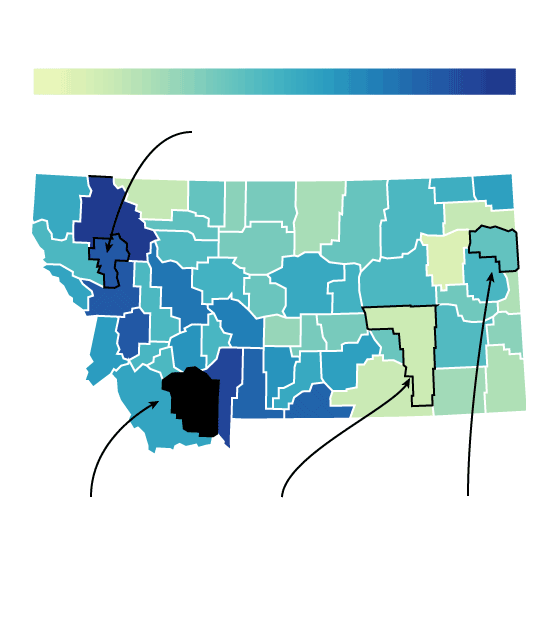

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

A Ranch View Natural Landmarks Travel Views

Montana Lawmakers Vote Unanimously To Oppose Property Tax Cap Initiative Montana Public Radio

Taxes Fees Montana Department Of Revenue

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Liheap Lihwap And Weatherization Assistance

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Tax Breaks For Montana Property Owners Inspect Montana

Taxes Fees Montana Department Of Revenue